stock market bubble definition

A stock market crash can be a side effect of a major catastrophic event economic crisis or the collapse of a long-term speculative bubble. The onset of the COVID-19 pandemic in early 2020.

Stock Market Crash Ahead The 2021 Stimulus Bubble 7 Key Bubble Factors Youtube

The stock market crash of 1929 was one of the worst in US.

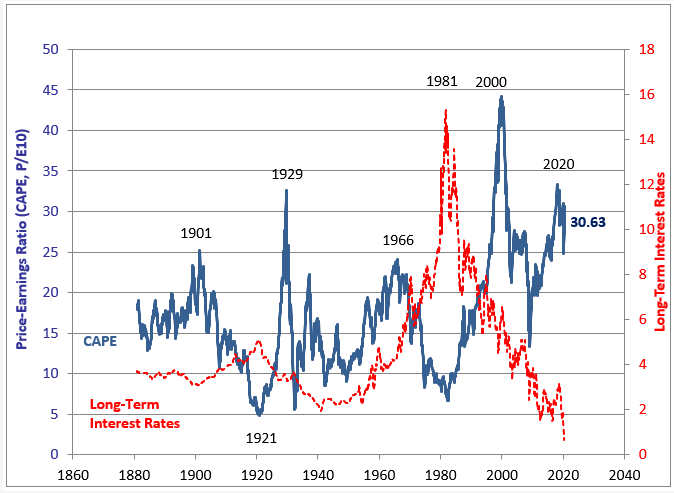

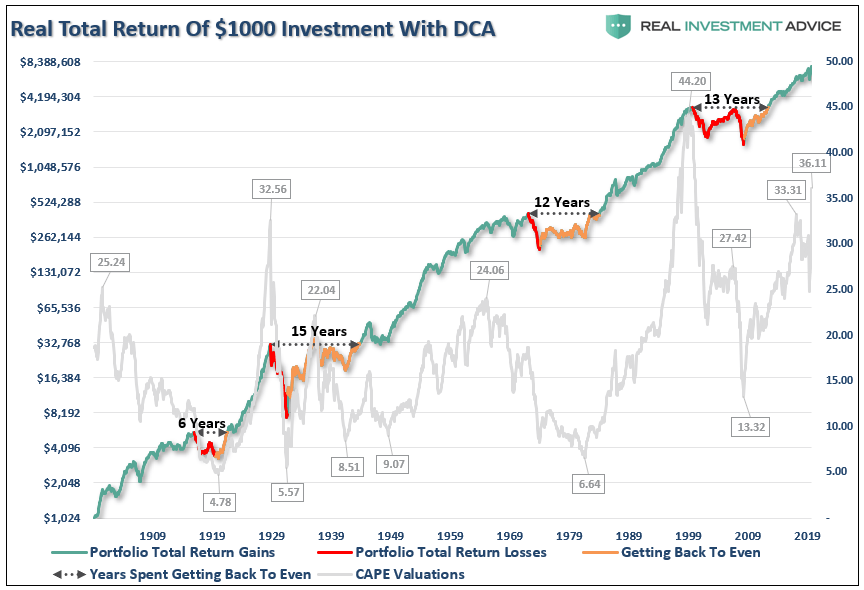

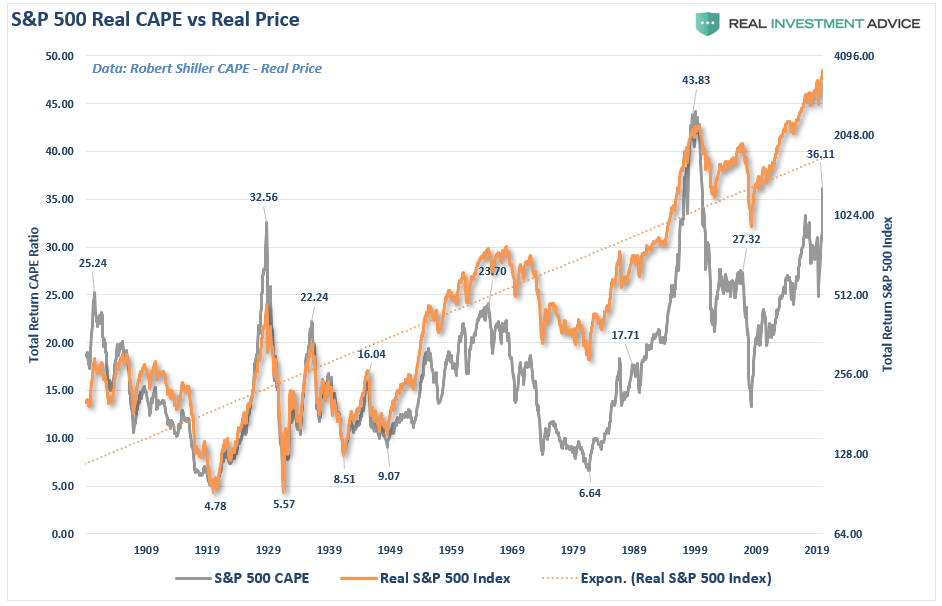

. About 25 years ago we felt in order to talk about bubbles we should probably define. When the debt bubble burst it caused the greatest stock market and economic crash in modern history. In this way expanding PE ratios can be a visible sign of a bubble.

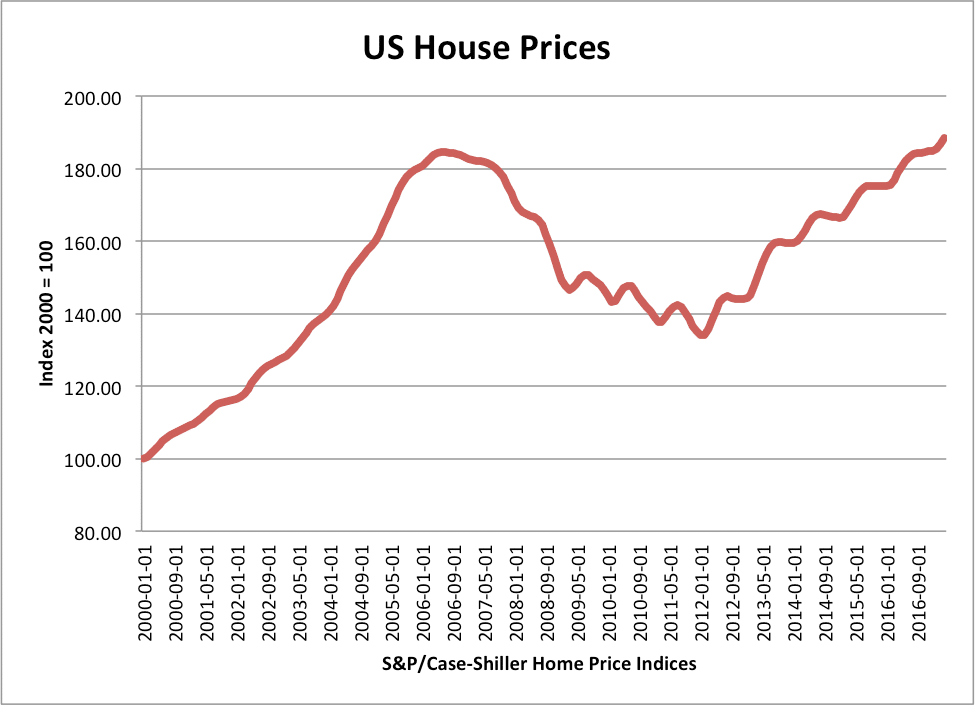

Despite market volatility following recovery from the global financial crisis historically low interest rates increased consumer spending and higher business profits a shift from investment in real estate to stocks and low inflation and savings rates have contributed to soaring stock prices since 2017. In a market so full of madness a big global stock market crash is coming. Overconfidence during the Roaring Twenties created an unsustainable stock market bubble.

An economic bubble also known as a market bubble or price bubble occurs when securities are traded at prices considerably higher than their intrinsic value followed by a burst or crash when prices tumble. A bubble is an economic cycle characterized by rapid escalation of asset prices followed by a contraction. A bear market is a general decline in the stock market over a period of time.

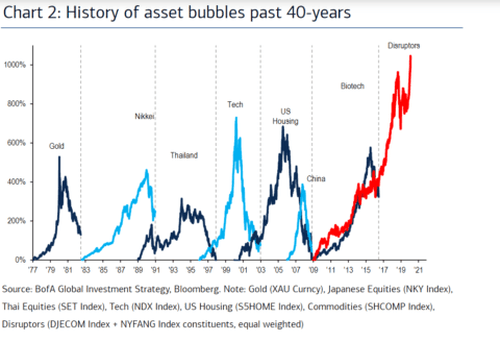

A market correction is said to have occurred when the stock marketas gauged by a major index like the SP 500falls in value by between 10. Arguably the greatest bubble of anytime anywhere and simultaneously they had 65 times earnings it was said at the time in the Japanese stock market. Looking at PE ratios and other.

The Dow rose above 21000 in mid. A stock market correction is a drop of between 10 and 20 in a major market index. The United States stock market was described as being in a secular bull market from about 1983 to 2000.

Read on to learn when you can expect a market correction what they mean for your portfolio why you shouldnt. Recession of 196061 and the dot-com bubble in 20002001 Bear market. RIVN stock has crashed in 2022 more decline could be on the table as lofty valuation remains.

Once new securities have been sold in the primary market they are traded in the secondary marketwhere one investor buys shares from another investor at the prevailing. For example if you were considering investing in the US stock market at the height of the dot-com bubble around 1999-2000 you might have noticed a sky-high PE ratio of over 40 and decided to hold off on investing. New Stock Market Asset Bubble.

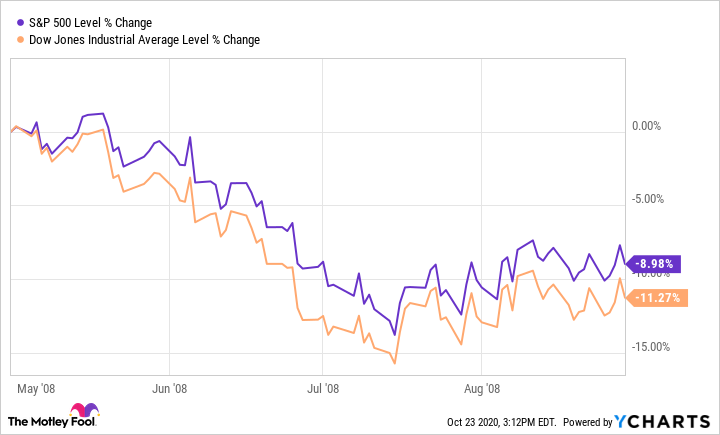

The bursting of the housing bubble and subsequent banking crisis in 2008 led to market-wide panic selling that turned into a serious recession. Losses are seen as a sign of future. 19 1987 the Dow Jones Industrial Average plunged.

The latter two days were among the four worst days the Dow has ever seen by percentage decline. Rivian needs to improve its fundamentals. It is a place where shares of pubic listed companies are tradedThe primary market is where companies float shares to the general public in an initial public offering IPO to raise capital.

The three key trading dates of the crash were Black Thursday Black Monday and Black Tuesday. Stock market a super bubble. The term is commonly used when talking.

Stock markets once examined every stock for value. Black Monday crash of 1987 On Monday Oct. One of the most famous stock market crashes started October 24 1929 on Black Thursday.

It is created by a surge in asset prices unwarranted by the fundamentals of the. It includes a transition from high. There have been a number of famous stock market crashes like the Wall Street Crash of 1929 the stock market crash of 19734 the Black Monday of 1987 the Dot-com bubble of 2000 and the Stock Market Crash of 2008.

And what makes the US. They indicate that prices are growing much faster than earnings. Reactionary public panic about a stock market crash can.

Today value investing is sneered at and the big boys are rushing into companies that have never made a profit just as during the dotcom boom and for the same reason. That was the ultimate definition of potential. Sculpture of stock market bear outside International Financial Services Centre Dublin.

2021 Another Voice Kkr Economic Analysis The Voice Private Equity

Stock Market Crash 1929 Definition Facts Timeline Causes Effects

Why It Could Be Years Until We See A Normal Housing Market In 2022 Housing Market Line Chart Marketing

Covid 19 Lockdowns Recession And A New Stock Market Bubble Real Instituto Elcano

The Coming Financial Bubble Why It May Be The Worst Of All Part I Bubble Economy Financial Bubbles

100 Stocks Annual 10 Year Rolling Returns Worst Case Scenario Risk Reward Government Bonds

A Brief History Of Major Financial Bubbles Crises And Flash Crashes

Stock Market Bubble Are We In One Right Now

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

Image Result For Dow Jones 100 Years Stock Market Trends Stock Market Marketing Trends

The Two Pins That Will Pop The Stock Market Bubble Seeking Alpha

Stock Market Bubble Meaning How It Affects Stock Market Rates Tradesmart

Related Image Stock Market Crash Stock Market Investing

See How To Identify And Trade Stock Market Bubbles

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

/dotdash_INV_final-Tech-Bubble_Feb_2021-01-f60580df62c24a79830dfb739e76af50.jpg)